San Antonio Embezzlement Lawyers

Embezzlement is wrongfully appropriating funds or property entrusted to one's care, typically by an individual responsible for managing those assets. This crime commonly occurs in professional settings, where employees or officers can access an organization’s finances and exploit that access for personal gain.

Unlike theft, which involves taking another's property without permission, embezzlement involves legally accessing the property and diverting it for unauthorized purposes. The diverted assets can be from the employer, clients, or third parties related to the alleged offender’s job. It can also include theft from charities or non-profit organizations. The crime of embezzlement falls under the law criminalizing theft.

Embezzlement is usually considered a white-collar crime. Many instances of embezzlement also involve elements of fraud. The crime carries heavy penalties, including fines and possible incarceration.

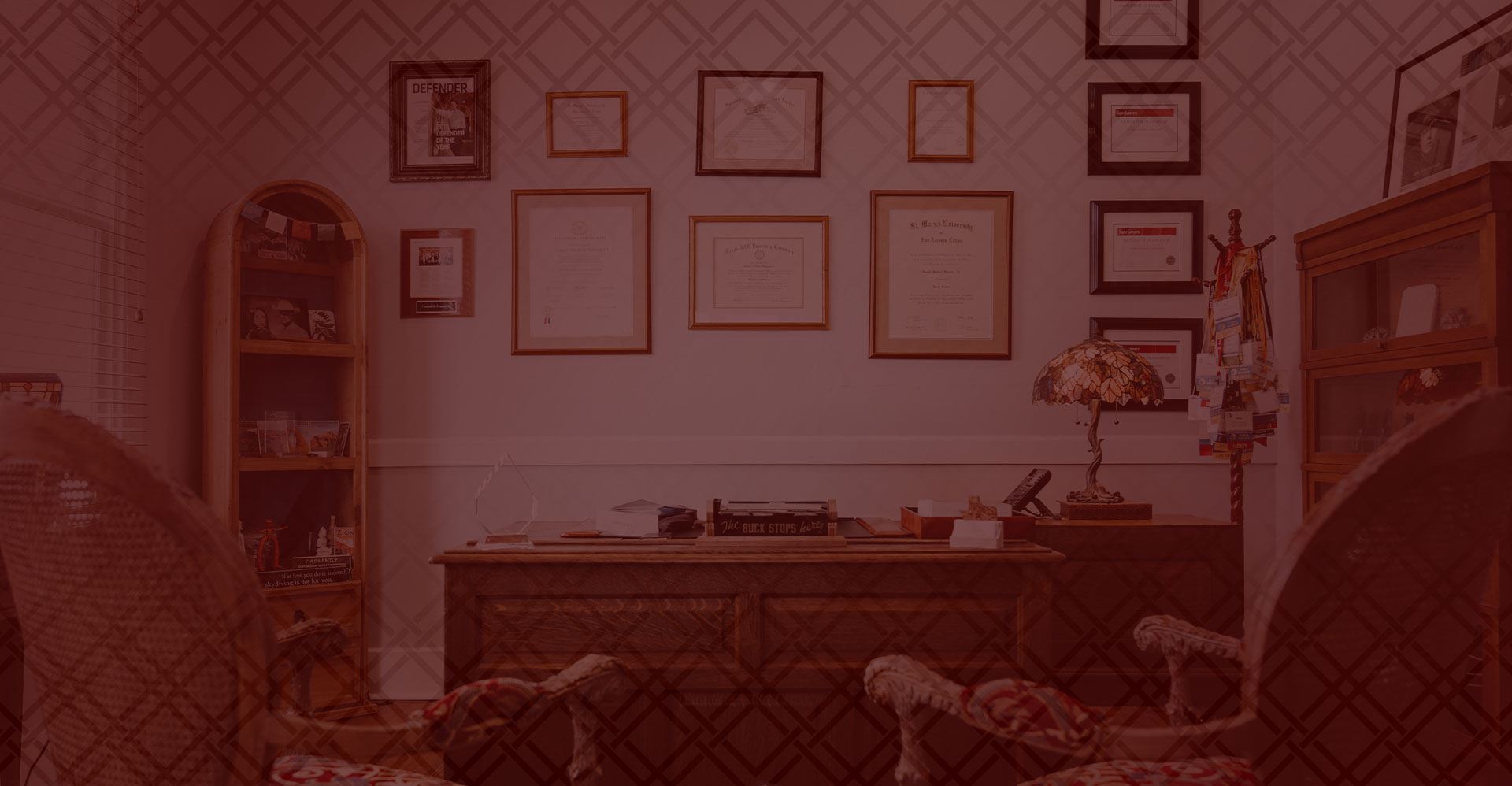

Embezzlement is a complex and severe offense with far-reaching consequences. Consulting a skilled attorney familiar with Texas and federal laws is crucial if you are accused of embezzlement. At Flanary Law Firm, PLLC, our competent criminal defense lawyers can guide you through the intricacies of your case, protect your rights, and take all necessary steps to strive for a favorable resolution.

Call (210) 899-7566 or submit our online contact form to schedule a free initial consultation with a San Antonio embezzlement attorney at Flanary Law Firm, PLLC.

Embezzlement in Texas

The Texas Penal Code does not have a specific statute dedicated to embezzlement. However, embezzlement and other similar crimes are consolidated under theft crimes.

Certain elements must be shown for a person to be convicted of embezzlement. Prosecutors must prove beyond a reasonable doubt that the alleged offender appropriated something of value from the true owner without consent. This can be money, goods, or property.

Some common ways a person can commit embezzlement include:

- Theft of funds from an employer;

- Theft of services or goods from an employer;

- Altering company books in some way to conceal income to the alleged offender’s employer; or

- Transferring funds from a corporate account of the alleged offender’s employer to their personal bank account.

Embezzlement Penalties in San Antonio

The penalties for embezzlement depend on the amount of money involved. If the value of the property embezzled is less than $100, the crime is a Class C misdemeanor, punishable by a fine of up to $500.

The crime of embezzlement is a Class B misdemeanor if the alleged offender does any of the following:

- The property embezzled is $100 or more but less than $750;

- The property embezzled is less than $100, and the alleged offender has a previous conviction for any grade of theft; or

- The property embezzled is a driver’s license, commercial driver’s license, or personal identification certificate.

The penalty for a Class B misdemeanor is up to 180 days in jail and a possible fine of up to $2,000.

The alleged offender will face a Class A misdemeanor if the embezzled property or money is $750 or more but less than $2,500. The penalty for a Class A misdemeanor is up to 12 months in jail and a possible fine of up to $4,000.

An embezzlement offense is a state jail felony in the following circumstances:

- If the property embezzled is $2,500 or more but less than $3,000;

- The property is less than 10 heads of sheep, swine, or goats or any part thereof under the value of $30,000;

- If the property is stolen from the person of another or a human corpse or grave, regardless of value;

- If the property embezzled is a firearm;

- If the value of the property embezzled is less than $2,500 and the alleged offender has been previously convicted twice or more of any grade of theft;

- If the property embezzled is an official ballot or official carrier envelope for an election;

- If the property embezzled is less than $20,000 and the property is aluminum, bronze, copper, or brass.

The legal consequences for a state jail felony include up to 24 months in jail and a possible fine of up to $10,000.

An embezzlement crime is a third-degree felony in the following circumstances:

- If the value of the property embezzled is $30,000 or more but less than $150,000;

- If the property is cattle, horses, or exotic livestock or fowl embezzled during a single transaction and having an aggregate value of less than $150,000;

- If the property is 10 or more head of sheep, swine, or goats embezzled during a single transaction and has an aggregate value of less than $150,000.

The legal punishment for a third-degree felony is up to five years in prison and a possible fine of up to $10,000.

Embezzlement is a second-degree felony in the following:

- If the property embezzled valued at $150,000 or more but less than $30,000; or

- If the property embezzled values less than $300,000 and the property embezzled is an automated teller machine or the contents or components of an automated teller machine.

A felony of the second degree is punishable by up to 20 years in prison and a possible fine of up to $10,000.

If a person embezzles property valued at $300,000 or more, they will face a first-degree felony punishable by up to 99 years or life imprisonment and a possible fine of up to $10,000.

Why Choose Flanary Law Firm, PLLC?

-

Constant CommunicationAt our firm, we always want our clients to feel empowered when defending against criminal charges. We aim to constantly communicate with our clients, answering questions and taking feedback as we progress through the case. We are always here to answer your questions or adjust your legal strategy as needed.

-

A History of ResultsWith multiple decades of experience between our attorneys, we have a history of proven results and happy clients. We always aim to get a criminal case dismissed or have the charges lowered to reduce any penalties our clients are facing. We are confident we can get you the results you deserve.

-

Experience You Can Count OnAt our firm, we pride ourselves on the diverse range of criminal cases we have worked on. From federal felony charges to state misdemeanors, we know exactly how to build a defense strategy that's right for you. Our team can handle even the most complex cases and are willing to be flexible with our strategies.

-

Advice on Your TimelineWe understand that all criminal cases work at different paces. Whether you are just looking around for a lawyer because you're under investigation or you need immediate representation, our team can help. We will work with you no matter where you are in the process to protect your rights.

-

Free Initial ConsultationsWe understand that hiring a criminal defense attorney is a big decision that many people need time to make. That's why we offer all our potential clients a free consultation to see if we're the right legal team for them. We will review your case and begin building a legal strategy to defend your rights.

-

Personalized Legal Defense StrategiesAll criminal cases are different, so our dense strategies are too. We would never re-use a legal strategy from one client to the next because your case is too unique. We will always build a defense strategy that's personalized and effective for you to get the outcome you deserve.

Statute of Limitations on Embezzlement in Texas

The statute of limitations for embezzlement in Texas generally provides a five-year window from the date the crime occurred to bring charges against the accused.

However, certain factors can influence this timeline. If the embezzlement was not immediately discovered, the statute might begin at the point of discovery. In cases where the embezzlement involved ongoing or repeated actions, the statute of limitations might extend to the last act of embezzlement.

Understanding the statute of limitations is critical for both the prosecution and defense, as it can impact the ability to pursue charges and accumulate evidence over time.